SwapsTech is now Finzly!

Check us out at Finzly.com

Solutions

International and Domestic Payments Hub

Payment is at the center of all customer transactions at the bank. With technology revolution, businesses and consumers are demanding faster payments. New payment rails are making quick inroads while the legacy payment schemes are becoming less attractive. Financial institutions need to quickly adopt and introduce new payment rails while supporting legacy and low-value payments. Technology must take the complexity out of the payment operations but silos of multiple systems does the exact opposite.

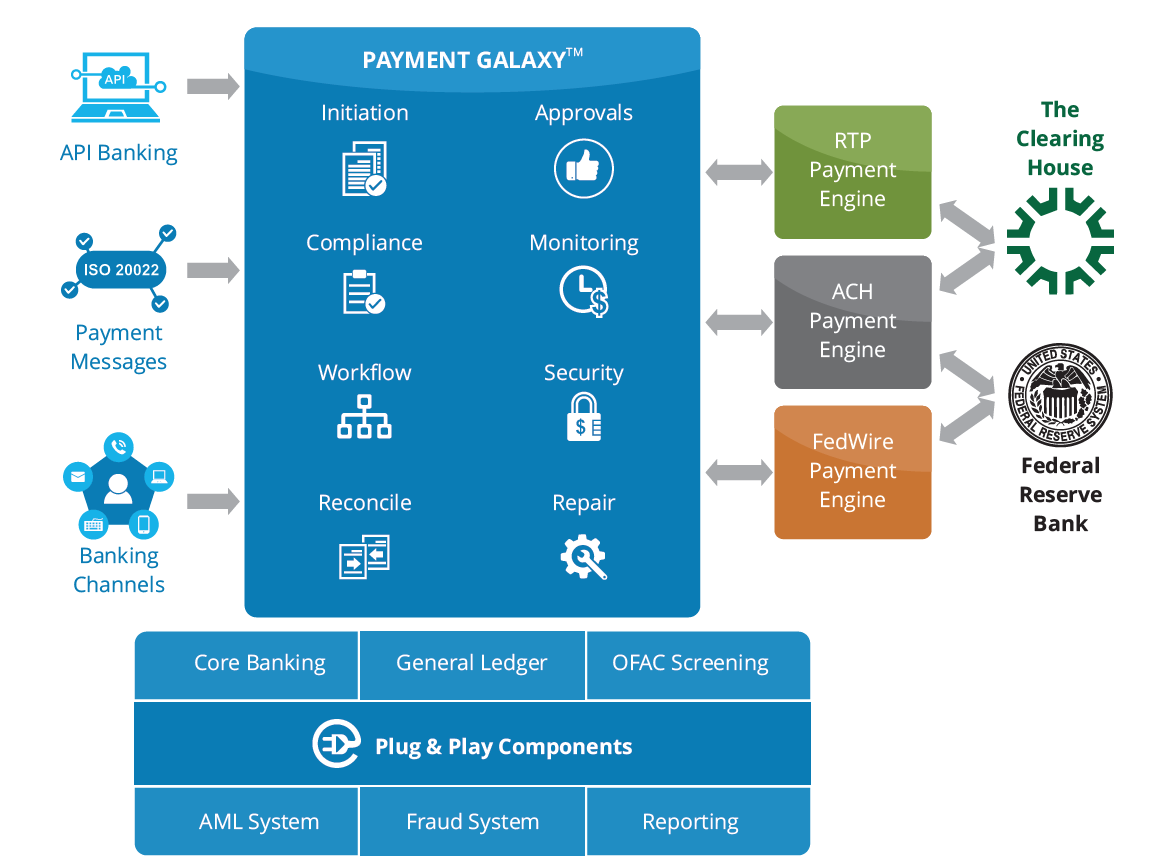

PAYMENT GALAXY™

PAYMENT GALAXY™ is the only system that delivers real-time payments while supporting legacy payments, with one user experience for all payment schemes, handling all the complexity with simple interface and a flexible architecture using plug & play components.

- PAYMENT GALAXY™ has an established connection with The Clearing House RTP payment network and offers a truly flexible plug & play system. Simply connect the PAYMENT GALAXY™ from your payment channels, initiate payments, track status, receive and respond to payment requests with complete visibility and reporting to the end user.

- PAYMENT GALAXY™ delivers real-time payments while supporting legacy payments including ACH & FedWire using the same user experience. Manage batch schedules, repair queues, returns, rejects, NOCs, and the complete life cycle of payments using simple yet powerful tools. Allow the channels connect to Payment Services using standardized API.

- PAYMENT GALAXY™ interoperates with SWIFT and other global payment schemes, enabling a truly global real-time payment experience. Send real-time payments to UK, Europe, India, Mexico, and many other real-time payments enabled countries using the combination of SWIFT GPI and local real-time payment networks, without ripping your existing SWIFT infrastructure

- PAYMENT GALAXY™ provides the true interoperability from one payment scheme to any other payment schemes in the world. For example, an incoming SWIFT GPI payment can interface with the national real-time payment network for real-time settlement and notifications back to SWIFT GPI tracker.

- The days of manual payments will be behind us very soon � stay innovative by offering powerful and secure open banking API. PSD2 complaint open banking API powers your clients and their ERP/Accounting system to connect with bank using tokenization to access account balances/transactions for reconciliations and manage payments without using the online portal.

FX STAR™ DESK

FX STAR™ Desk is a front office, pricing, trading and risk management module, supporting all FX asset classes including Derivative products.

Manage quoting through a multi-tiered auto-pricing matrix, with a real time dealing interface. FX STAR™ Desk provides a seamless trade execution and trade management experience for clients. For Dealer, FX Desk provides advanced tools for managing positions, risk, and P&L. Manage credit with an integrated real time credit engine and address regulatory requirements with a unique regulatory management engine.

Connect with liquidity providers, through direct interface or aggregation platforms to efficiently price and layoff the risk based on custom rules. The report builder provides tools for quickly and easily creating customized reports - analyze trade history, risk, P&L and many other reports. FX derivatives are efficiently managed with automated NDF fixing, option triggers, expiry and exercise.

- Tiered Pricing by Size, Currency, Customer, Time of trade and more.

- Automated Quote & Cover with Liquidity Providers.

- Blended and/or marked up Market Data for Pricing.

- Pre-trade Dodd-Frank Compliance, Limit and Fraud check.

- Dealer Intervention Controls with Manual Pricing.

- Aggregated Positions, Risk, P&L from a variety of channels.

- Automated auto-hedging from Forward to Spot books.

- Real-time Risk & Limit Management.

- Slice and dice P&L by Year, Month, Region, Sector, RM, Customer and more.

- Custom report builder for Trade, Risk, P&L and more.

- Simple NDF Fixing and Option Exercise.

- In-memory grid architecture with realtime access to trade, risk and P&L.

- Simple trade booking with integrated P&L calculator.

- Slice and dice pivot tables.

- Custom report builder.

FX STAR™ OFFICE

FX STAR™ Office is a powerful back office system for efficient and secure post-trade processing with tailored workflow solutions. Each institution is unique, their customer base, internal processes, business systems and product focus are different. Servicing clients and the growth of business is often limited by the legacy systems that support your payment and capital markets business lines – keeping this in mind, FX STAR delivers a powerful plug and play based trade processing system, that easily integrates with any system, orchestrated by configurable workflows that maximizes straight-through processing, yet provides the ability to integrate manual controls when required, with maximum efficiency.

- Simplified plugin to integrate with bank’s DDA system to check balance in real-time, memo post, override posting error, and finally hard post.

- SWIFT plugin to instruct correspondent banks to confirm the trade, process payment, receive incoming wires, receive trade confirmations and receive nostro statements.

- Integrated and automated OFAC/Compliance screening, score based auto approval, false positive approval, BSA approval and audit tracking process.

- Country specific payment requirement configuration and enforcing the required fields for payments.

- Integrated BIC directory, IBAN validation, and international bank identifier validation.

- Workflow-driven PDF confirmation generation and transmission process, with a client interface to confirm, or upload signed confirmation.

- Automated SWIFT confirmation with automated and manual matching.

- Efficient incoming wire processing.

- Simple and powerful Nostro Reconciliation process and reporting.

- Automated regulatory reporting engine.

- Simpler draft collections, draft image upload, clearing, and FX conversion process.

- Comprehensive Investigation management and reporting.

- Automated MTM report generation and transmission plugin.

- Detailed and best market practice journal entry generation and reporting plugin.

- Automated End of day processing with controls to run earlier.

- Straight through processing with manual control when required.

- Out of the box, best market practice workflow tailored to suit your institution’s unique needs.

- Readily available plugins to integrate with DDA, SWIFT, GL and AML systems.

- System access is driven by entitlements and two-factor authentication.

- Maker and checker function for crucial processes.

- Integrated document management system to manage all customer agreements and documents.

- Simple and powerful, template driven report builder.

FX STAR™ BRANCH

FX STAR™ Branch portal allows employees at wire processing room or at remote bank locations to process FX payments, cash letters, and bank notes in real time. This portal provides institutions with the tools to deliver personal, efficient foreign currency banking services across all locations, while adhering to regulatory and best market practices while maintaining complete oversight of risk management.

- Integrated Dodd-Frank Act 1073 disclosure and cancellation provision for consumer wires.

- Configurable rate engine, with start of the day or periodically updated or live rates for pricing.

- Customizable pricing tiers for consumers and corporate clients.

- Exchange rate calculator with simplified payment page.

- Initiate both foreign currency and local currency (USD) wires, settling cross-border or domestic.

- Flexible to manage the risk in-house or automatically quote and cover with liquidity provider.

- Integrated BIC, IBAN, CLABE, IFSC and other international bank identifier validation.

- Capture country specific payment instructions, reduce payment delays and improve STP.

- Circulate information including holiday notices and announcements for Branch users.

- Multiple layers of security to protect the transaction.

- Two-factor authorization.

- Maker checker function to approve payments.

- Restricted access by geographic regions.

- Restricted access to branch and wire room employees.

MCA STAR

SwapsTech's Multi-Currency Account management system enables the financial institutions to create and offer foreign currency denominated accounts to their client base. MCA accounts can be used to buy/sell currencies, receive incoming wires without converting to domestic currency, initiate foreign currency wires without FX translation, manage foreign loans, deposits and more. MCA STAR is plugged into SwapsTech’s FX and Loan back office platforms, for seamless, simpler and faster settlement processing and accounting.

- Create multiple sub-accounts from one Nostro account.

- Dedicated or shared Nostro account for MCA accounting.

- Manage account maintenance and transaction fees.

- Powerful Nostro Account management and reconciliation tool.

- Daily valuation of Nostro balances, MCA balances, and P&L reporting.

- Automated MCA statement generation and transmission.

- Detailed journal entry generation, revaluation, and reporting.

- Integrated with SwapsTech’s client portal to manage and transact from MCA accounts.